Did Louisiana Double, Triple Or Quadruple The Size Of The Us

Table of Contents

P&F Bearish Breakdowns

Introduction

There are v bearish breakdown P&F patterns. In fact, these five are the exact opposite of the v bullish breakdown patterns. The nigh basic P&F sell signal is a Double Lesser Breakup, which occurs when an O-Cavalcade breaks below the low of the prior O-Column. From this basic design, the bearish breakup patterns become wider and more complex. The wider the pattern, the better established the back up level and the more of import the subsequent breakdown. This commodity will look at the five primal breakup patterns in detail and so show measuring techniques for price objectives.

Double Bottom Breakdown

In the P&F earth, Double Lesser Breakdowns are bearish patterns that are confirmed with a support break. With bar charts, on the other manus, Double Bottoms are bullish patterns that are confirmed with a resistance interruption. These patterns are not contradictory. They are simply unlike patterns with similar names.

As noted higher up, the most fundamental P&F sell signal is when an O-Column breaks below the low of the prior O-Cavalcade. These two columns are separated by an X-Column. O-Columns denote falling prices, while X-Columns signify ascent prices. The first falling O-Cavalcade establishes direction. The middle X-Column represents a bounce that establishes resistance. The 3rd O-Column triggers the lower low. The disability to agree the prior low shows weakness associated with a downtrend.

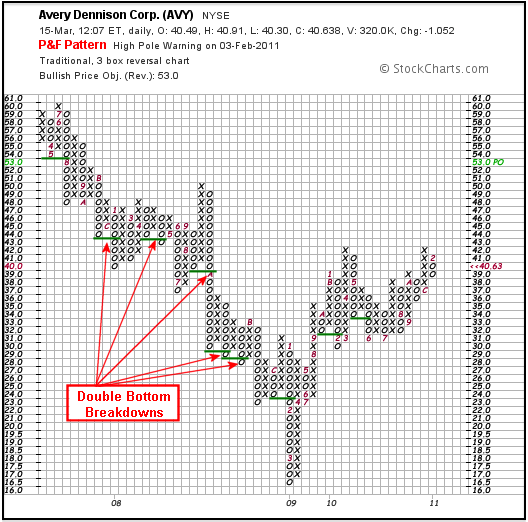

Every bit the nearly common betoken in the P&F universe, Double Bottom Breakdowns are as well the most prone to whipsaw and failure. Double Bottom Breakdown signals should be viewed in the context of the bigger motion-picture show. It is important to employ other aspects of technical assay when using signals as common every bit Double Bottom Breakdowns. The chart below shows Avery Dennison (AVY) with several Double Bottom Breakdowns over the last few years.

Triple Bottom Breakdown

The Triple Bottom Breakdown takes the Double Bottom Breakup 1 step further by calculation some other back up column. Two consecutive O-Columns ascertain support with two equal lows. The third O-Column breaks below the lows of the prior ii O-Columns to forge the Triple Bottom Breakup. Classic Triple Lesser Breakdowns are v columns broad: three O-Columns and two Ten-Columns.

These patterns can mark reversal breakdowns or continuation breakdowns. Distinguishing between reversal and continuation depends on the prior move. A Triple Bottom Breakdown that forms as a elevation after an accelerate would be deemed a reversal pattern. A Triple Lesser Breakdown that forms as a consolidation after a decline would be viewed as a continuation pattern.

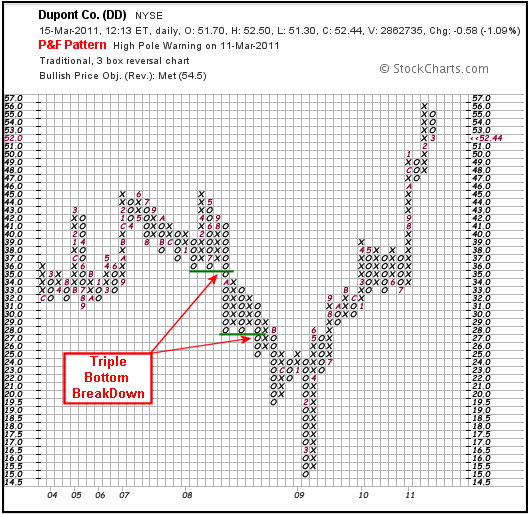

The chart above shows Dupont (DD) with a reversal Triple Lesser Breakdown in the start half of 2008 and and then a continuation Triple Bottom Breakdown in the second one-half. While it is sometimes difficult to distinguish between reversal patterns and continuation patterns, the Triple Lesser Breakdown itself is piece of cake to place with a articulate support break.

Spread Triple Lesser Breakup

Every bit its name implies, the Spread Triple Bottom Breakup is an expanded version of the Triple Bottom Breakdown. A Spread Triple Bottom Breakup contains at least two extra columns, which ways information technology is at least seven columns wide. An extra X-Column and an extra O-Cavalcade form lows above the bodily support level or breakdown point. These columns in effect add space or width to the Triple Lesser Breakdown. As with a normal Triple Bottom Breakdown, a Spread Triple Bottom Breakup is confirmed with a intermission below the lows of the two O-columns. Ideally, a Spread Triple Bottom Breakdown forms as a Triple Bottom Breakdown with only two extra columns. In reality, this pattern tin can form with more two extra columns.

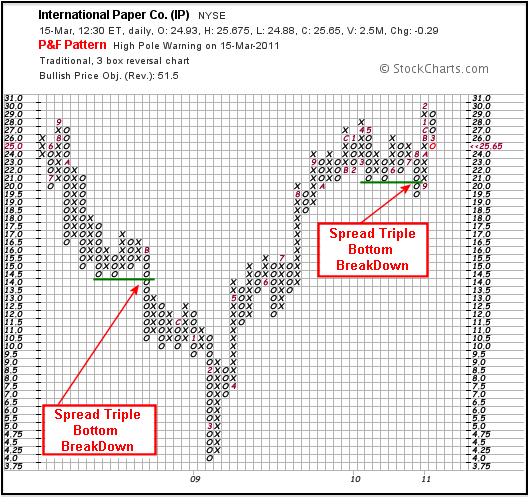

The nautical chart above shows International Paper with ii Spread Triple Bottom Breakdowns. The beginning one in 2008 marked a continuation of the downtrend. The second Spread Triple Bottom Breakup triggered in August 2010, simply resulted in a whipsaw (bad signal). First, the breakup did not hold long. 2d, the X-Column broke above the high of the breakup cavalcade (O-Column).

Descending Triple Bottom Breakup

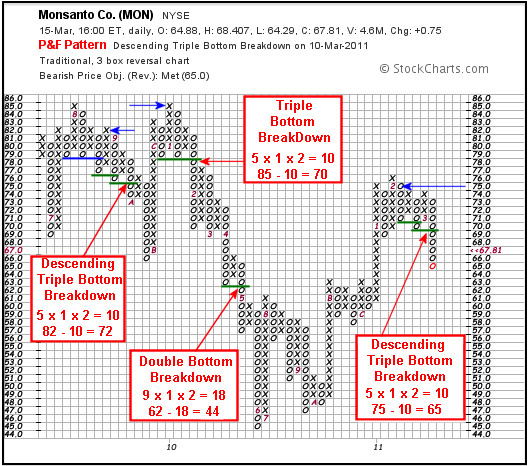

A Descending Triple Lesser Breakup is basically back-to-dorsum Double Bottom Breakdowns. These breakdowns form three O-Columns that move lower and lower with each breakdown. Because there are three O-Columns and two 10-Columns, the pattern is just as wide as a classic Triple Bottom Breakdown. The ability to forge back-to-dorsum lower lows shows underlying weakness that is indicative of a downtrend. As with the other patterns, this Descending Triple Bottom Breakup can form as a continuation or reversal design.

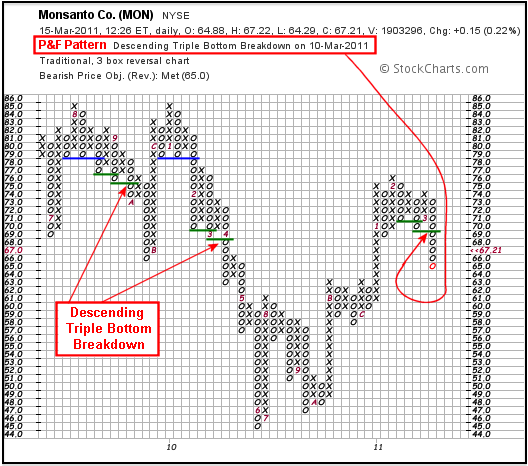

The above chart for Monsanto (MON) shows three Descending Triple Bottom Breakdowns. The first ii occurred afterwards Triple Bottom Breakdowns (blue lines), which makes then continuation patterns. The tertiary breakdown formed afterwards an advance that peaked in early on 2011. This is a reversal pattern.

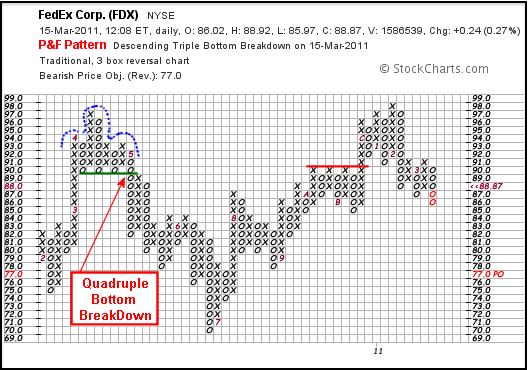

Quadruple Bottom Breakdown

The Quadruple Bottom Breakup is just similar the Triple Bottom Breakdown, only with an extra O-Column to mark support and an extra X-Column to widen the pattern. Iii consecutive O-Columns define support with three equal lows. The 4th O-Column breaks beneath the lows of the prior 3 O-Columns to forge the Quadruple Bottom Breakdown. All told, Quadruple Bottom Breakdowns are 7 columns wide with four O-Columns and iii X-Columns. These patterns can marking reversal breakdowns or continuation breakdowns.

The nautical chart above shows FedEx (FDX) with a reversal Quadruple Bottom Breakdown in May 2010. This reversal pattern also resembles a head-and-shoulders. Find the relatively equal highs for the shoulders and the spike high for the head. Confirmation is clear with the Quadruple Bottom Breakdown.

Measuring Techniques

First and foremost, be careful with price objectives. They are really just crude guidelines. Chartists should utilise other aspects of technical assay to confirm objectives and continuously monitor the country of the trend/breakdown.

The horizontal count method tin be applied to Triple Bottom Breakdowns, Descending Triple Bottom Breakdowns, Spread Triple Bottom Breakdowns, and Quadruple Bottom Breakdowns. Simply measure out the width of the pattern, multiply by the box size and and so past 2/3 the reversal amount. Tom Dorsey and A.W. Cohen advocated 2/3, but some P&F chartists simply employ the full reversal amount. Subtract this total from the pattern loftier for a price objective. The wider the pattern, the bigger the expected movement. Triple Bottom Breakdowns are five columns wide (3 O-Columns and ii X-Columns), Quadruple Bottom Breakdowns are seven columns broad and Spread Triple Lesser Breakdowns are seven columns minimum.

The vertical count method can exist applied to Double Bottom Breakup Breakdowns. Subsequently the breakup, chartists must wait for a 3-box reversal to Ready the height of the breakdown cavalcade. The breakdown column is bailiwick to change until at that place is a reversal. This reversal is considered a mere bounce as long equally information technology does not extend too far. Count the number of filled boxes in the breakdown column, multiply by the box size so by ii/three the reversal amount. Subtract this product from the pattern high for a downside cost objective.

The chart above shows Monsanto (MON) with four surly breakup patterns and 4 downside price objectives. The blue arrows mark the design high, from which the extension estimate is subtracted. The first, a Descending Triple Bottom Breakdown, came merely later a Triple Lesser Breakdown. Even though the pattern is near the summit, information technology is considered a continuation pattern because information technology follows the previous breakdown. The second, a Triple Bottom Breakdown, is clearly a reversal design because it formed at the prior high. The third, a Double Bottom Breakdown, formed within a downtrend. The vertical count method was used to notice a cost objective of 44, which missed the bottom by i box. The most recent pattern is a Descending Triple Bottom Breakdown with a downside toll objective of 65.

Establishing a price objective only covers the reward office of the risk-reward equation. Chartists should also study the chart to assess risk. A move above resistance or the blueprint high would clearly negate a breakdown. The box just higher up the pattern high often marks the worst-instance level for a blueprint failure. Similarly, a Double Top Breakout or a contradictory P&F pattern would argue for a reassessment. In that location are sometimes failure clues earlier price hits the worst-instance level. Chartists should utilise other technical assay techniques to measure run a risk and monitor the unfolding tendency. Come across our ChartSchool articles for more than details on Horizontal Counts, Vertical Counts and Timeframes for P&F charts.

Conclusion

The most basic P&F sell signal comes from a Double Bottom Breakdown. From hither, the classic patterns widen to course consolidations with well-divers back up levels. Reversal patterns form as a top after an extended advance, while continuation patterns act as a rest after a significant decline. A lilliputian congestion, a clear support level, and a definitive breakdown indicate make these patterns relatively easy to spot.

Did Louisiana Double, Triple Or Quadruple The Size Of The Us,

Source: https://school.stockcharts.com/doku.php?id=chart_analysis:pnf_charts:pnf_bearish_bd

Posted by: johnsonwousidersing.blogspot.com

0 Response to "Did Louisiana Double, Triple Or Quadruple The Size Of The Us"

Post a Comment